Perfect Competition

Perfect Competition is a model used as the starting point to explain how firms operate

It is a theoretical model based upon some very precise assumptions

(Use agriculture as an example of perfect competition in exam question)

Assumptions of perfect competition

The assumptions (exam questions sometimes ask to elaborate on two of these)

- Demand is perfectly elastic

- AR=MR=D

- Firms have no power

- Price changes only for the market mechanism

- Large number of buyers

- Large number of firms

- All products are homogeneous

- The firms produce exactly identical products/services (homogeneous = the same)

- It is not possible to distinguish between a good produced in one firm and a good produced in another

- There are no brand names and there is no marketing to attempt to make a good different from another

- Firms are price-takers

- Individual firms have to sell at whatever price is set by demand because there is a high competition (idealistically the number of firms is infinite)

- Each firm is so small relative to the size of the industry that it is not capable of altering its own output to have a noticeable effect upon the output of the industry as a whole

- Firms cannot affect the supply chain of the industry and so cannot affect the price of the product

- No barriers to enter/exit from the market

- Firms are completely free to enter or leave the industry at any moment

- This means that firms already in the industry do not have the ability to stop new firms from entering it and they are also free to leave the industry if they wish

- Profit maximization always assumed as a key objective

- Information is perfect

- All producers and consumers have a perfect knowledge of the market

- Producers are fully aware of market price, costs in the industry and the workings of the market

- The consumers are fully aware of the prices in the market, The quality of good and the availability of goods

- All firms have access to factors of production

Case Study: Wheat European Union

- There are some large wheat farms in the EU but they are very small in relation to the whole wheat growing industry

- An individual farm could increase its output many times over without having any noticeable effect on total supply

- A single farm is not able to affect the price of wheat in the EU since it cannot shift the industry supply curve

- The farm has to sell at whatever price the industry price is

- In addition wheat is wheat and there is no way to distinguish

- Although firms are relatively free to enter or leave the wheat industry there are significant costs in doing either and these may affect decisions of firms

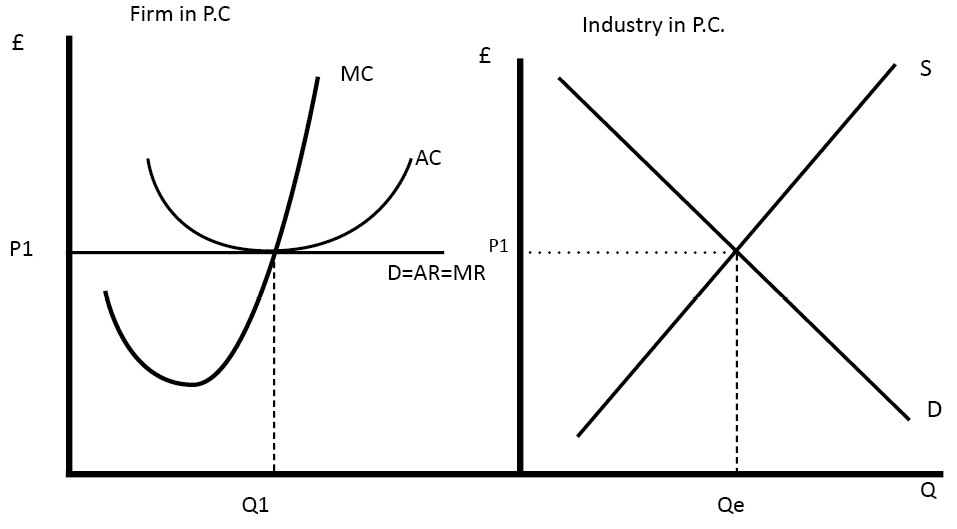

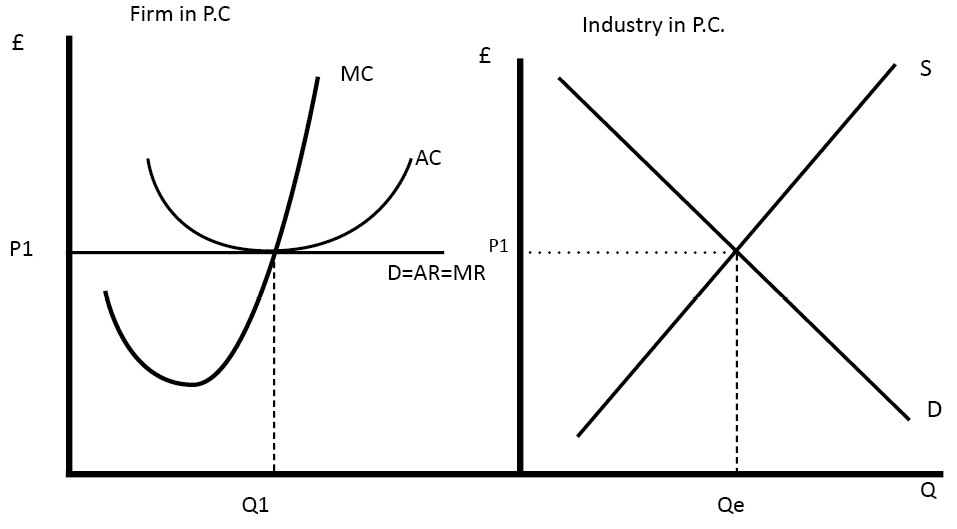

Perfect competition graphs

Perfect competition in the short run

Short run- abnormal profit diagram

- Profit = (P - C) x Q

- P = Even with red dotted line

- C = Bottom Blue Line

- Q = Level of output

Short run - losses diagram

Why are losses/abnormal profit not possible in long run for perfect competition

If firms are making abnormal profit other firms will enter the market and will, therefore, increase the supply of the product and drive the price down.

Movement from short-run abnormal profit to long-run normal profit diagram :

Note: the reverse occurs for short-run losses

Some firms will leave the industry due to loses which will not have an effect because firms are small.

As more firms leave the industry, it is unable to achieve normal profits, so the industry supply curve will shift to the left.

Long run equilibrium in perfect competition

In long run, firms will make normal profit

Productive and allocative efficiency in perfect competition

Productive efficiency: A firm is said to be productively efficient if it produces its product at the lowest possible unit costs (average cost) MC = AC

- Productive efficiency is important in economics, because if a firm is producing at the productively efficient level of output then they are using their resources as efficiently

- Resources not being wasted

Allocative Efficiency: Allocative efficiency occurs when suppliers are producing at the optimal mix of goods and services required by the consumers

- Price reflects the value that consumers place on a good and is shown on the demand curve (average revenue)

- Allocative efficiency is important in economics because if a firm is producing at the allocatively efficient of the output there is a situation of “PARETO OPTIMALITY” where it is impossible to make one party better off without making another worse off

Marginal cost: This reflects the cost to society of all the resources used in producing an extra unit of a good including the normal profit required for firms to stay in business

- If the price were to be greater than marginal cost then the consumers would value the good more than it costs to make

- If both sets of stakeholders are to meet at the optimal mix then output would expand to the point where price equals marginal costs.

Comparison of long run and short run in perfect competition

|

TIme period

|

Abnormal Profits

|

Losses

|

Allocatively efficient

|

Productively efficient

|

|

Short Run

|

Y

|

Y

|

Y

|

N

|

|

Long Run

|

N

|

N

|

Y

|

Y

|

Monopolies

A market structure characterized by a single seller, selling a unique product in the market. In a monopoly market, the seller faces no competition, as he is the sole seller of goods with no close substitute. T

Assumptions of a Monopoly

-

There is one firm, the firm is the industry

-

Barriers to entry exist, which stops new firms from entering the industry and maintains the monopoly

-

Because of the barriers to entry, the monopolist may be able to make an abnormal profit in the long runs

What firms are monopolies?

Whether a firm really is a monopoly depends upon how narrowly we define the industry.

For example, while Microsoft may be the only producer of a particular kind of software, it does not have a monopoly on all software.

Examples of monopolies:

-

Swiss Rail system

-

Pharmaceutical Patents

- Google

Strength of Monopoly Power

The strength of monopoly power possessed by a monopoly will really depend upon how many competing substitutes are available.

If you as a consumer NEED to buy a product and only one company sells this (as is often he case with pharmaceuticals) you will pay whatever price to have that product.

Barriers to Entry which allow for monopolies

A monopoly may continue to be the only producer in any industry if is able to stop other firms from entering the industry in some way

These ways of preventing entry to industry are known as barriers to entry, and they are divided into two categories. Economies of scale and barriers to entry.

Economies of scale

If a monopoly is large then they will experience economies of scale. These are advantages which allow them to lower their average cost as their size increases, due to specialization, labor division and bulk buying.

Any firm wishing to enter industry often must start up small and so will not have the economies of scale that are enjoyed by the monopolist. Even if the new firm were able to start on the same size as the monopolist, it would still not have expertise in the industry such as managerial economies, promotional economies and R&D.

Without economies of scale, a would-be entrant, knows that it would not be able to compete with the existing monopolist who would simply reduce the price to a level of normal profits, destroying demand for the competition. Since they will be making losses the lack of economies of scales prevents them from joining the market.

Natural Monopoly

This is where due to the nature of the product the market can only hold one firm. Alternatively only one firm is allowed to exist by the government

- E.g For a utility company, the industry is too small and not profitable enough for 2 firms

Demand curve for monopolies

A Monopoly is the industry and therefore the monopolies demand curve is the industry demand curve and is downward sloping

-

The monopolist can control either the level of output or the price of the product, not both

-

Some people wrongly the monopolist can charge whatever price they like and still sell the products. This is not the case, in order to sell more they must lower the price

Reasons for low price elasticity:

- Legal barriers

- Brand Loyalty

- Anti-competitive behavior

Ex. Microsoft fined for anti-competitive behavior. when it bundled other products with windows, destroying competition for their competitors.

Possibility of Abnormal Profit in A Monopoly

If a monopolist is able to make abnormal profit in the short run and has effective barriers to entry then other firms cannot enter the industry and compete away the profits that are being earned

-

It is sometimes assumed that monopolists would always earn abnormal profits but this is not always true

-

If the monopolist produces a produces something for which there is little demand then it will not earn abnormal profits

-

If the monopolist were making losses in the short run, then it would have the option of closing down temporarily if it was not covering its variable costs or continuing production for the time being

-

If normal profits cannot be earned in the long term the firm will have to close

Perfect Competition vs Monopolies

Advantages of Monopolies

Disadvantages of Monopolies

Unfair Profits of Monopolists

-

The high profits of monopolists may be considered as unfair especially by competitive firms or those on low economies

-

The scale of the problem depends upon the size and power of the monopoly

-

The Monopoly profit of your local post office may seem of little consequence when compared to the profits of a giant national company �

Monopolistic Competition

Essentially a monopolistic competitive market is one with freedom of entry and exit, but firms can differentiate their products. Therefore, they have an inelastic demand curve and so they can set prices.

Assumption of a Monopolistic Competition

-

Industry is made up of a large number of firms

-

No barriers to entry or exit

-

There is product differentiation - A good or service is perceived to be different from other goods or services in some way

- Physical Differences (Size, taste, texture, packaging…)

- Quality Differences

- Location (hotels near airports)

- Services (Home delivery or warranties)

- Product Image (Celebrity Advertising, brand names, attractive packaging)

Examples of Monopolistic Competition

- Book Publishing

- Clothing

- Shoes

- Processed Foods

- Jewellery

- Furniture

- Textiles

- Dry Cleaners

- Gas Stations

- Restaurants

- Mechanics

- Plumbers

Similarities to the other market Structures

-

Perfect Competition

-

Monopoly

Brand Loyalty is possible in Monopolistic Competition

-

Some consumers will be loyal and continue to buy it if the price goes up

-

For example, a consumer of a certain plumber will stay with the same plumber even when he raises his prices above local competitors due to perceived higher skill

-

Brand Loyalty means that producers have some element of independence when they are deciding on price

-

They are to an extent price makers so they have a downward sloping demand curve

-

However, demand will be relatively elastic since there are many slightly different substitutes

�

Abnormal Profits and short run losses in Monopolistic Competition

Due to the lack of Barrier to Entry or Exit, abnormal profits are not possible in the long run because other firms can see that a firm is making abnormal profit and therefore other firms will enter the market and take away profits.

Short run losses are possible but like perfect competition long run losses are not possible

- If average cost is under average revenue then there is abnormal profit

- If Average cost intersects average revenue then there is normal profit

- If Average cost is below average revenue then there are losses

profit maximization point: MC = MR is the PROFIT MAXIMISATION POINT

Intersection point of AC and MC: Average Cost Intersects Marginal cost at its minimum

Can Monopolistically competitive firms have productive efficiency or Allocative efficiency?

- Firms in monopolistic competition are not productively efficient because MR ≠ MC

- Firms in monopolistic competition are not allocatively efficient because MR ≠ AR

�

Oligopolies

Assumptions of an Oligopoly

-

Oligopoly is where few firms dominate an industry

-

The number of firms could be large or small

-

Large proportion of the industry is shared by just a small number of firms

-

What constitutes a small number varies but a common indicator is known as the concentration ratio (CRx)

Concentration Ratios

Types of Oligopolistic Industries

-

Oligopolistic Industries may be very different in nature

-

Some produce almost identical products such as petrol, the product is the same and only the oil companies name changes

-

On the other hand, could be a highly differentiated such as cars

Firms have Interdependence, meaning that they all set the same price because if the priced too low they would lose revenue and if they priced to high they would lose demand.

Collusion in Oligopolies

-

Formal Collusion

-

(Usually illegal) involves executives from companies meeting to decide on the outcome, many countries have laws against it.

-

Legal between governments

-

Such as a OPEC “Organization of Petroleum Exporting Countries”

-

Opec is a cartel

-

Sets production quotas which has very significant influence on the price of oil on the world market

-

Acts a monopoly

-

Usually results in higher prices and is deemed to be against the interests of consumers

-

Collusion is generally banned by governments and is against the law in the majority of countries.

-

Tacit Collusion

-

Where the best course of action is implied

-

Happens without any agreement or formal collusion

-

Occurs when a firm simply charges the same as that of the other competitors

Oligopolies and Price Issues

-

Oligopolies tend to be characterised by Price Rigidity

-

Prices in oligopolies tend to change much less than in more competitive markets

-

Even when production costs changes the oligopolistic firms tend to leave prices unchanged

This is due to the collusion, firms collaborating means they can make abnormal profit and therefore they would want to keep prices stable to maintain profits.

Oligopoly acting as a Monopoly

The Kinked Demand Curve

One way to attempt to explain the situation in a non-collusive oligopoly is the kinked demand curve devised in the 1930s by an american economist called paul sweezy, the theory has be questioned on its accuracy but brings up interesting concerns

The kinked curve explains why there tends to be price rigidity.

-

Firms are afraid to raise prices above current market price as other firms will not follow and so they lose sales and usually profit.

-

Firms are afraid to lower prices below current market prices as other firms will follow, undercutting them and so creating a price war that will harm all firms involved

-

The shape of the MR Curve means that if marginal costs were to rise then it is possible that MC would still equal to MR and so the firm bein profit maximisers would not change prices or outputs

Non Price Competition

As firms in oligopoly tend not to compete in terms of price the concept of non price competition becomes important.

Types of non price competition:

Advertising in an Oligopoly

Oligopoly is characterised by very large advertising and marketing spending as firms try to develop brand loyalty and make demand for their product less elastic.

Some may argue that this represents a misuse of scarce resources but it could be argued that the competition between the large companies results in greater choices for consumers

Editors- Nhf1185 - 2648 words.

- joeClinton - 121 words.

- admin_andrei - 38 words.

View count: 26450